Investing in Tin Stocks: A Lucrative Opportunity

Understanding Tin Stocks

Tin stocks have garnered significant attention from investors looking to diversify their portfolios and capitalize on the growing demand for this versatile metal. Tin is a vital component in various industries, including electronics, automotive, and packaging, making it a promising investment opportunity for those seeking long-term growth potential.

Factors Influencing Tin Prices

Several factors influence the price of tin, making it essential for investors to stay informed and proactive in their investment strategies. Global supply and demand dynamics, geopolitical tensions, economic conditions, and technological advances all play a role in determining the price of tin. By monitoring these factors closely, investors can make informed decisions and capitalize on potential opportunities in the market.

Benefits of Investing in Tin Stocks

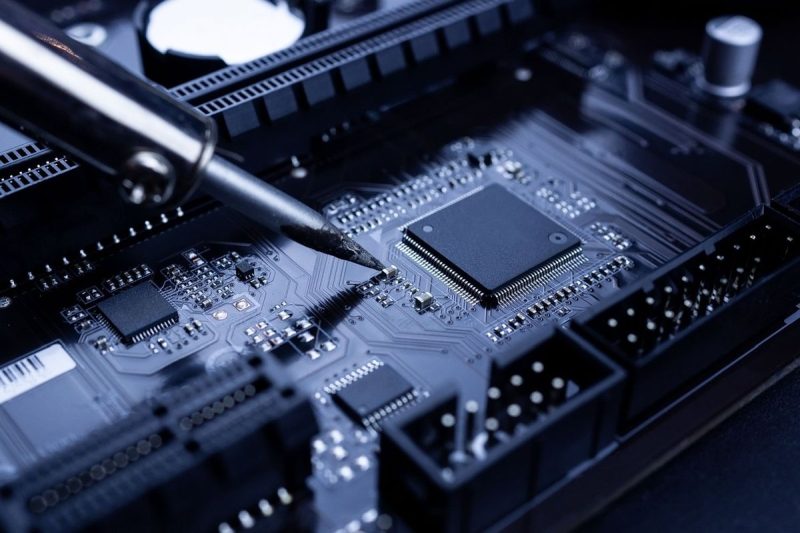

Investing in tin stocks offers a range of benefits for investors looking to capitalize on the metal’s unique properties and increasing demand. Tin is a critical component in soldering electronics, which are essential in the production of various consumer goods. Additionally, tin’s anti-corrosive properties make it an ideal choice for packaging materials, further driving demand for the metal. By investing in tin stocks, investors can benefit from the metal’s diverse applications and its potential to deliver strong returns over time.

Strategies for Investing in Tin Stocks

When considering investing in tin stocks, investors should conduct thorough research and due diligence to identify potential opportunities in the market. Diversification is essential, as investing in a range of tin-related companies can help mitigate risks associated with individual stocks. Additionally, staying informed about market trends and developments in the tin industry can help investors make informed decisions and adapt their strategies as needed.

Risks Associated with Tin Investments

While investing in tin stocks offers compelling growth potential, it is essential to be aware of the risks associated with such investments. Volatility in tin prices, regulatory changes, geopolitical risks, and supply chain disruptions can all impact the performance of tin stocks. Investors should carefully assess these risks and consider implementing risk management strategies to protect their investments and optimize their returns.

Conclusion

Investing in tin stocks can be a lucrative opportunity for investors seeking exposure to a metal with diverse applications and growing demand. By understanding the factors influencing tin prices, evaluating the benefits and risks of tin investments, and developing informed strategies, investors can position themselves to capitalize on the potential opportunities in the market. With careful consideration and proactive decision-making, investing in tin stocks can offer long-term growth potential and help diversify investment portfolios effectively.