The week ahead looks to be challenging for the Nifty as it continues to face several levels of resistance that could impede any significant upward momentum. Traders and investors are advised to proceed with caution and closely monitor the market dynamics to make informed decisions.

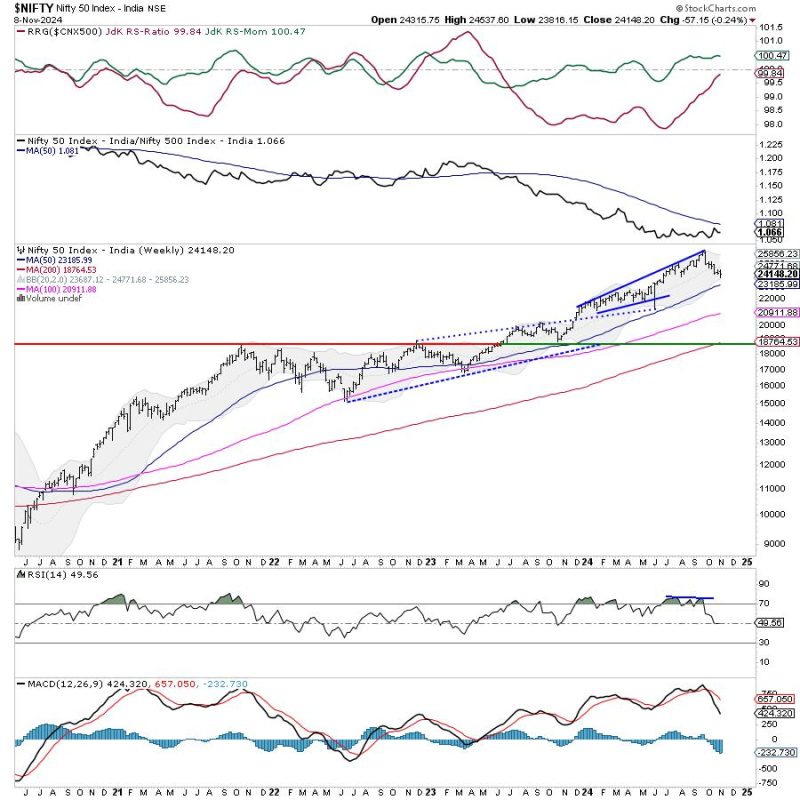

Technical analysis suggests that the Nifty is currently dealing with multiple resistance levels, making it increasingly difficult for the index to make a strong push upwards. These barriers could prove to be formidable hurdles for the bulls, preventing any substantial gains in the near term.

One of the key resistances that traders need to keep an eye on is the 15,900 level. This critical zone has been acting as a strong barrier to the index’s upward movement and has thwarted several attempts to break through. Without a decisive breakthrough above this level, the Nifty is likely to struggle to gain bullish momentum.

Additionally, the 50-day moving average (DMA) is also posing as a significant hurdle for the Nifty. The 50-DMA is an important technical indicator that is closely watched by traders and investors to gauge the short to medium-term trend of an index. Currently, the Nifty is trading below its 50-DMA, indicating a bearish bias in the market sentiment.

Another crucial level of resistance for the Nifty is the 15,700 mark. This level has proven to be a key turning point for the index, acting as a support and resistance zone in the past. Traders should closely monitor how the Nifty behaves around this level as a breakout or breakdown could signal the next direction for the index.

In addition to these technical hurdles, the market sentiment is also being influenced by global cues and macroeconomic factors. Uncertainty surrounding the Covid-19 situation, inflationary pressures, and upcoming economic data releases could further complicate the market outlook and lead to increased volatility in the week ahead.

To navigate through this period of uncertainty, traders are advised to adopt a cautious approach and focus on risk management. It is essential to have a well-defined trading strategy, set stop-loss levels, and closely monitor the market developments to make timely decisions.

In conclusion, the Nifty is likely to face several hurdles in the week ahead, with multiple resistance levels impeding any significant upward movement. Traders should exercise caution, closely monitor the key technical levels, and stay informed about market dynamics to navigate through the challenging environment successfully. By staying vigilant and adaptable, traders can position themselves effectively to capitalize on potential opportunities and mitigate risks in the market.