The reference article from GodzillaNewz discusses the ongoing secular bull market in financial markets, characterized by a major rotation in sectors as investors adjust to changing conditions. The article highlights key points indicating the current state of the market and provides insights into potential trends that investors can anticipate.

One of the critical aspects pointed out in the reference article is the continued strength of the secular bull market, despite various challenges and changes in market dynamics. The article suggests that investors should remain cautious and aware of shifts in sector performance to better position themselves for maximizing returns.

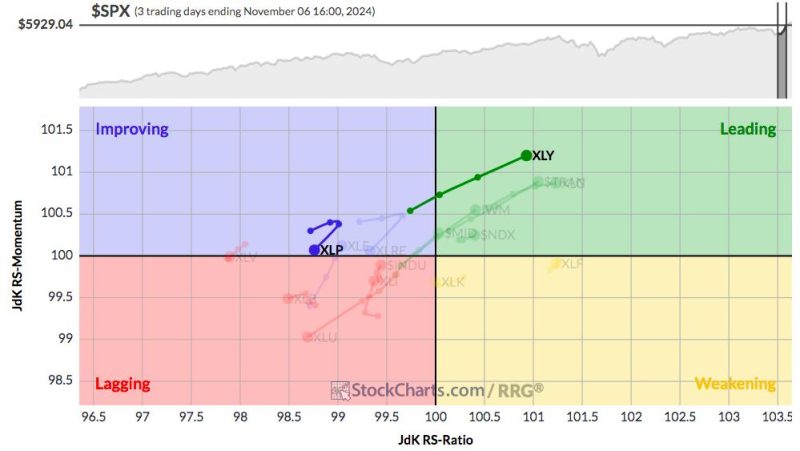

Moreover, the article emphasizes the importance of understanding the concept of market rotation, where money moves from one sector to another based on changing economic conditions and investor sentiments. This rotation can present both risks and opportunities for investors, making it essential to stay informed and adapt investment strategies accordingly.

Additionally, the reference article highlights the significance of diversification in a portfolio, especially during periods of sector rotation within a secular bull market. By spreading investments across different sectors and asset classes, investors can mitigate risk and take advantage of opportunities emerging from market shifts.

Furthermore, the article underscores the need for active management and continuous evaluation of investment holdings to align with the evolving market landscape. This proactive approach can help investors capitalize on emerging trends and outperform market benchmarks.

In conclusion, the reference article provides valuable insights into navigating the current secular bull market and sector rotation trends. By staying informed, diversifying portfolios, and actively managing investments, investors can adapt to changing market conditions and position themselves for long-term success in the dynamic financial landscape.