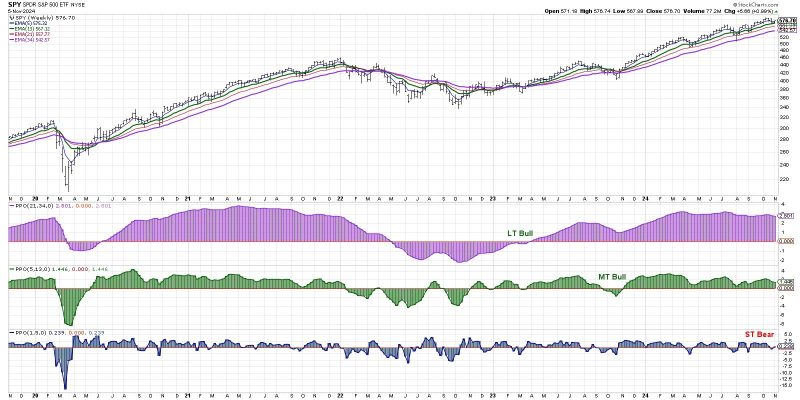

In a week heavy with news and uncertainty, the financial markets are bracing themselves for potential shifts and fluctuations. While investors typically seek stability and positive trends, the current signals indicate a short-term bearish outlook in the near future.

One significant factor fueling this bearish sentiment is the anticipation surrounding various news events set to unfold in the coming days. Events such as central bank announcements, economic data releases, and geopolitical developments all have the potential to disrupt market equilibrium and trigger volatility.

Central bank decisions, in particular, hold substantial influence over market movements. Any indication of policy changes or shifts in interest rates can have a profound impact on investor sentiment and asset prices. With global central banks closely monitored by market participants, any unexpected announcements can lead to rapid market reactions.

Furthermore, economic data releases play a crucial role in shaping market expectations. Indicators such as employment figures, inflation rates, and GDP growth numbers provide valuable insights into the health of an economy. Any surprises or deviations from forecasts in these data points can lead to increased market uncertainty and potential sell-offs.

Geopolitical events and developments also pose a significant risk to market stability. Tensions between nations, trade disputes, or unexpected geopolitical crises can all contribute to heightened volatility in financial markets. Investors remain vigilant and are closely monitoring these events for any potential impact on their portfolios.

Overall, the combination of these factors has created a climate of caution and bearishness among investors. As the markets brace for a week packed with potentially market-moving news, traders and analysts are adjusting their strategies and risk management techniques to navigate the uncertainty ahead.

In conclusion, while short-term bearish signals may be prevalent in the current market environment, investors should remain vigilant and adaptable to navigate the ever-changing landscape of financial markets. By staying informed, employing sound risk management practices, and being prepared for unexpected developments, investors can better position themselves to weather the storm and seize opportunities amidst volatility.