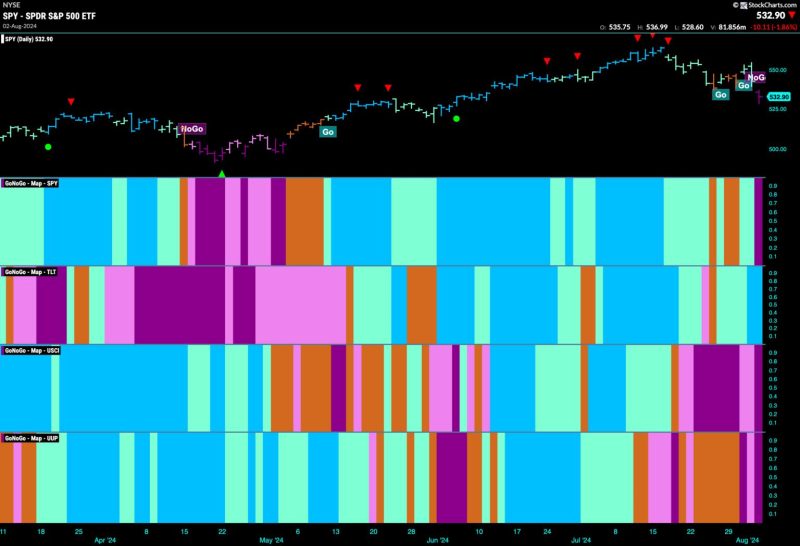

Stocks Get Defensive as Market Index Enters ‘NoGo’ Zone

The recent shift in the stock market towards defensive sectors has caught the attention of investors and analysts alike. As the market index enters what some are calling the ‘NoGo’ zone, it signals a potential shift in investor sentiment and a move towards safer investment options. This change in direction is influenced by a combination of factors, including economic uncertainty, geopolitical tensions, and market volatility.

One of the key indicators of this defensive stance is the performance of sectors traditionally considered less risky during times of market turbulence. Utilities, consumer staples, and healthcare stocks have seen an uptick in demand as investors seek stability and dependable returns. These sectors are known for their resilience during economic downturns, making them attractive options for risk-averse investors looking to protect their portfolios.

On the flip side, high-flying tech stocks and other growth-oriented sectors have experienced selling pressure as investors reallocate their capital towards more defensive plays. The tech sector, in particular, has been hit hard as concerns about stretched valuations and regulatory scrutiny weigh on investor sentiment. This rotation away from high-growth names could signal a broader shift towards value and income-oriented investments in the coming months.

Another factor driving the move towards defensive stocks is the uncertain economic outlook. The ongoing trade tensions between the US and China, coupled with slowing global economic growth, have raised concerns about the sustainability of the current bull market. Investors are bracing for a potential downturn and are adjusting their portfolios accordingly to weather any upcoming storms.

Geopolitical tensions, such as the escalating conflict in the Middle East and uncertainty surrounding Brexit, are also contributing to the defensive posture adopted by investors. These geopolitical risks have the potential to disrupt global markets and introduce a new wave of volatility, prompting investors to seek safety in defensive sectors.

Market volatility has been another major catalyst for the shift towards defensive stocks. The recent bouts of turbulence in the stock market, characterized by steep sell-offs and sudden reversals, have rattled investor confidence. In response, investors are flocking to defensive sectors that offer stability and lower downside risk, providing a cushion against potential market downturns.

In conclusion, the move towards defensive stocks signals a shift in investor sentiment towards safety and stability in the face of economic uncertainty, geopolitical risks, and market volatility. While no one can predict the future direction of the market with certainty, being mindful of these trends and adjusting one’s investment strategy accordingly can help navigate turbulent waters and protect one’s portfolio from potential downside risks. As always, diversification and a long-term perspective remain key principles in building a resilient investment portfolio that can weather market storms.