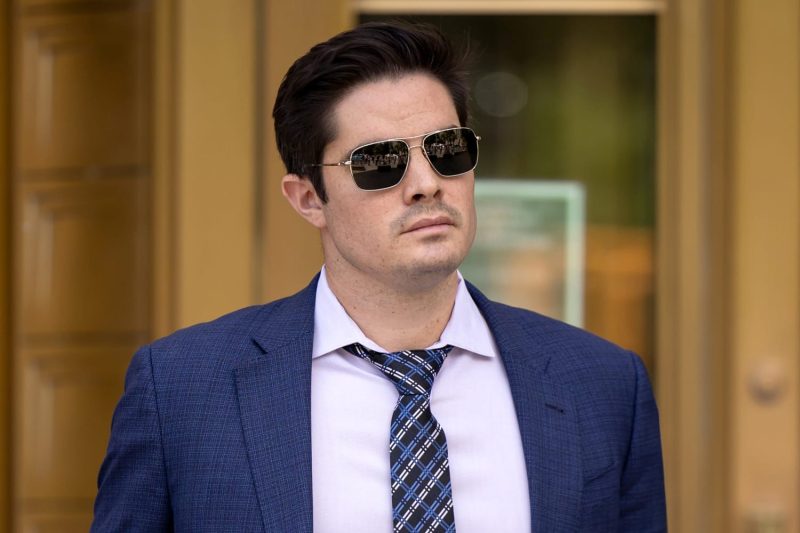

In a recent turn of events within the world of cryptocurrency trading, the sentencing of Jonathan Rosloss, a former FTX executive who turned against the founder of the platform, Sam Bankman-Fried, has sent shockwaves through the industry. With a sentence of 7.5 years in prison looming over him, Rosloss finds himself at the center of a high-profile legal saga that has captured the attention of many cryptocurrency enthusiasts and industry insiders.

Rosloss, once a trusted member of the FTX team, made headlines when he decided to cooperate with authorities in their investigation into alleged illegal activities within the company. His decision to turn on Bankman-Fried, who is widely regarded as a prominent figure in the cryptocurrency world, has raised questions about loyalty, integrity, and the complexities of the legal system.

The case against Rosloss stemmed from allegations of fraud, money laundering, and other white-collar crimes that were said to have taken place during his time at FTX. While the full details of the charges have not been publicly disclosed, it is clear that the consequences of his actions have been severe. The 7.5-year prison sentence serves as a stark reminder of the potential repercussions of engaging in illegal activities, especially within the fast-paced and often unregulated world of cryptocurrency trading.

As the cryptocurrency market continues to evolve and gain mainstream acceptance, incidents like the one involving Rosloss and Bankman-Fried shed light on the challenges and risks associated with the industry. While many view cryptocurrencies as a revolutionary force that has the potential to transform the financial landscape, others remain skeptical of the lack of oversight and regulation that often characterizes this space.

For individuals like Rosloss, who once held positions of power and influence within cryptocurrency companies, the allure of quick wealth and the pressure to succeed in a competitive market can sometimes lead to ethically questionable decisions. The consequences of such decisions can be far-reaching, not only affecting the individuals involved but also casting a shadow of doubt over the entire industry.

In the case of Rosloss, his sentencing serves as a cautionary tale for those who may be tempted to cut corners or engage in illegal activities in pursuit of financial gain. It also underscores the importance of upholding ethical standards and compliance with the law in an industry that is still navigating its way through uncharted territory.

As the cryptocurrency market continues to mature and attract interest from investors, regulators, and the general public, incidents like the one involving Rosloss and Bankman-Fried highlight the need for transparency, accountability, and integrity within the industry. While the allure of cryptocurrencies may be strong, it is essential for individuals and companies alike to operate within the bounds of the law and adhere to ethical principles to ensure the long-term sustainability and credibility of this burgeoning sector.