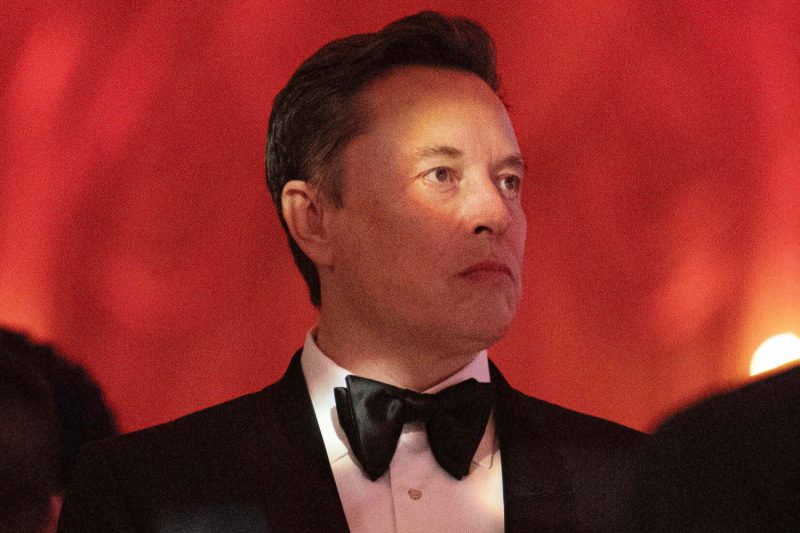

Elon Musk, the visionary CEO of Tesla, recently faced a setback in his quest for an ambitious pay package. A closely watched dispute over Musk’s eye-catching $56 billion pay package came to a resolution, with the court ruling against the tech billionaire. The legal battle has drawn attention not just for its high stakes but also for what it reveals about the complex relationship between executive compensation, corporate governance, and shareholder empowerment.

At the heart of the matter was Musk’s 2018 compensation package, which was tied to ambitious performance targets for Tesla. The pay package included an all-or-nothing award that would only be fully realized if Tesla achieved specific milestones, including market capitalization targets and revenue growth. Musk, known for his relentless drive and ambitious goals, had a personal stake in pushing Tesla to achieve these targets, with his compensation directly linked to the company’s success.

However, not everyone was on board with Musk’s pay package. A group of shareholders challenged the award, arguing that it was excessive and not in the best interests of Tesla shareholders. The case brought to light broader concerns about executive compensation in the tech industry, where top executives often receive hefty pay packages that are not always tied to clear performance metrics.

The court’s ruling against Musk’s pay package represents a significant moment in the ongoing debate over executive compensation. On one hand, Musk’s supporters argue that his pay package was a fair reward for his role in transforming Tesla from a niche electric car company to a global powerhouse. They point to Tesla’s impressive growth and market performance as evidence that Musk’s leadership has been crucial to the company’s success.

On the other hand, critics of Musk’s pay package argue that it sets a dangerous precedent for executive compensation, creating incentives for short-term gain at the expense of long-term sustainability. They contend that Musk’s outsized pay package could lead to excessive risk-taking and a focus on meeting short-term targets at the expense of building a sustainable business.

The ruling against Musk’s pay package sends a clear signal that shareholders are increasingly willing to challenge executive compensation arrangements that they view as excessive or not aligned with the long-term interests of the company. It highlights the growing importance of shareholder activism and corporate governance in shaping executive pay practices.

As Musk navigates this setback, it remains to be seen how Tesla will adjust its compensation practices and how this ruling will impact the broader debate over executive pay in the tech industry. The case serves as a reminder that executive compensation is not just a matter of numbers but also a reflection of broader issues of corporate governance, shareholder activism, and the balance between short-term incentives and long-term sustainability.