In analyzing the current economic conditions and market trends, one cannot ignore the impact that the USD has on global financial markets. The recent fluctuations in the value of the USD have brought about speculation regarding whether the currency is setting up for a perfect rally.

The USD has seen its fair share of volatility in recent times, affected by various factors such as economic indicators, political developments, and market sentiment. The global economic outlook, especially in the wake of the COVID-19 pandemic, has further complicated the situation, leading to uncertainty and caution among investors. However, amidst these challenges, there are indications that the USD could be gearing up for a significant rally.

One key factor supporting the possibility of a USD rally is the strength of the US economy compared to other major economies. Despite the impact of the pandemic, the US economy has shown resilience and adaptability, with positive growth forecasts and a robust recovery trajectory. This economic strength could attract investors seeking stability and potential returns, thus driving up demand for the USD.

Moreover, the Federal Reserve’s monetary policy stance has also played a crucial role in shaping market expectations regarding the USD. The Fed’s commitment to maintaining accommodative policies while keeping inflation in check has provided a sense of stability and confidence among market participants. Should the Fed continue on this path and effectively manage any potential risks, it could further bolster the USD’s position.

Another factor that could contribute to a USD rally is geopolitical developments and uncertainties. The USD is often seen as a safe-haven currency during times of global turmoil and unrest. With ongoing geopolitical tensions and economic challenges in various parts of the world, investors may increasingly turn to the USD as a secure asset, driving its value higher.

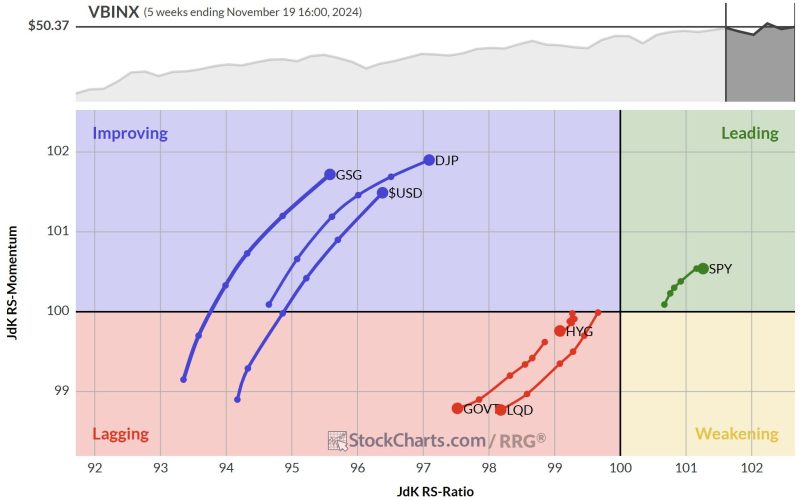

Technical analysis of the USD’s performance in the forex market also suggests the potential for a rally. Chart patterns and trend indicators point towards a possible breakout or reversal in the USD’s value, indicating that traders are positioning themselves for a bullish run.

However, it is essential to note that predicting currency movements is a complex and speculative endeavor, influenced by numerous unpredictable variables. While the USD may be showing signs of a rally, unforeseen events or shifts in market sentiment could quickly change the outlook.

In conclusion, the USD appears to be setting up for a potential rally based on various economic, financial, and geopolitical factors. The currency’s strength relative to other major currencies, the Federal Reserve’s policy stance, and market dynamics all point towards a bullish momentum for the USD. Nonetheless, investors and traders should exercise caution and closely monitor developments to navigate the evolving landscape of the forex market.