Investing in Chromium Stocks: A Comprehensive Guide

Understanding the Chromium Market

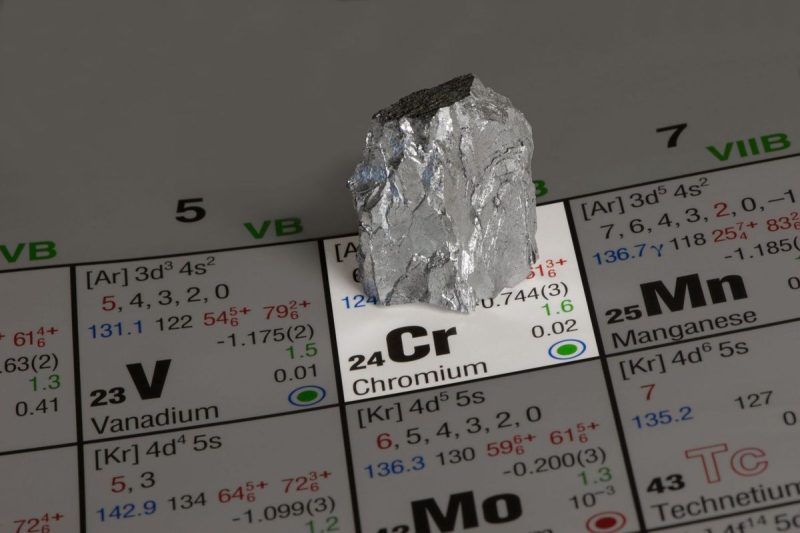

Chromium is a versatile element that plays a crucial role in various industries, including stainless steel production, aerospace, and automotive sectors. As a result, the demand for chromium continues to rise, presenting investors with promising opportunities in the stock market.

Factors Influencing Chromium Prices

Several factors can impact the price of chromium stocks, including supply and demand dynamics, geopolitical events, technological advancements, and environmental regulations. Investors need to stay informed about these factors to make well-informed decisions when investing in chromium stocks.

Analyzing Chromium Stocks

Before investing in chromium stocks, it is essential to conduct thorough research and analysis. Evaluate the financial health of chromium mining companies, their market positioning, growth prospects, and management team. Additionally, consider macroeconomic trends and industry-specific factors that can affect chromium prices in the long term.

Diversification and Risk Management

As with any investment, diversification is key to managing risk when investing in chromium stocks. Avoid concentrating your portfolio on a single company or sector to minimize the impact of potential market fluctuations. By spreading your investments across multiple chromium stocks and other asset classes, you can reduce risk exposure and increase the potential for long-term returns.

Long-term vs. Short-term Investment Strategies

Investors can adopt various strategies when investing in chromium stocks, depending on their financial goals and risk tolerance. Long-term investors may focus on companies with strong fundamentals and growth potential, holding onto their investments for an extended period to benefit from capital appreciation and dividends. Conversely, short-term investors may engage in active trading to capitalize on price fluctuations and market trends.

Monitoring Market Trends and Performance

To make informed investment decisions, investors should regularly monitor market trends, industry developments, and the performance of chromium stocks. Stay updated on relevant news and reports, track stock price movements, and assess the impact of external factors on the chromium market. By staying informed, you can adjust your investment strategy accordingly and seize opportunities for growth.

Seeking Professional Advice

Investing in chromium stocks can be complex, requiring a deep understanding of the industry and market dynamics. If you are unsure about where to start or how to build a profitable investment portfolio, consider seeking advice from financial advisors or seasoned investors. They can provide valuable insights, recommend suitable investment options, and help you navigate the intricacies of the stock market.

In conclusion, investing in chromium stocks offers a unique opportunity for investors to capitalize on the growing demand for this essential element across various industries. By conducting thorough research, diversifying your portfolio, and staying informed about market trends, you can make strategic investment decisions that align with your financial goals and risk tolerance.