The article highlighted on Godzilla Newz addresses the recent trends observed in the Nifty index, shedding light on the violation of key support levels and how it has affected the resistance levels in the market. The narrative provides a comprehensive overview of the current scenario in the stock market and lays out the implications for investors and traders alike.

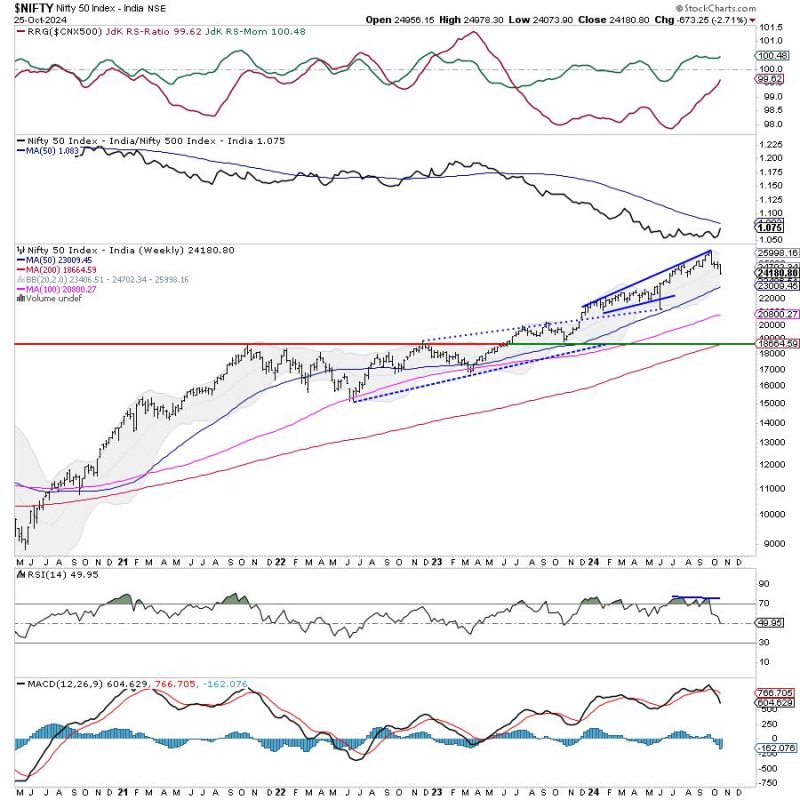

The piece begins by emphasizing the significance of key support levels in the context of technical analysis. It explains how these support levels act as critical markers that indicate the strength or weakness of a particular asset. In the case of the Nifty index, breaching these support levels signifies a bearish trend, signaling potential challenges ahead for market participants.

Additionally, the article delves into the concept of resistance levels and their relationship with support levels. It elucidates how the violation of key support levels can exert downward pressure on resistance levels, thereby creating a more challenging environment for market participants to navigate. By providing this insight, the piece equips readers with a deeper understanding of the dynamics at play in the stock market.

Furthermore, the article discusses the implications of these developments for traders and investors. It highlights the importance of staying vigilant in the face of changing market conditions and emphasizes the need for adaptability and risk management strategies. By recognizing the impact of violated support levels on resistance levels, market participants can make more informed decisions to protect their investments and seize opportunities that may arise.

In conclusion, the article on Godzilla Newz serves as a valuable resource for individuals looking to gain insights into the current trends in the stock market, particularly concerning the Nifty index. By exploring the interplay between key support and resistance levels, the piece offers a nuanced perspective on the challenges and opportunities present in today’s market environment. Readers are encouraged to leverage this information to make well-informed decisions and navigate the complexities of the stock market with greater confidence.