In recent years, the concept of artificial intelligence (AI) has gained significant attention in the investment world. One of the most exciting developments within the AI space is the emergence of AlphaFold, a deep learning system developed by DeepMind Technologies, a subsidiary of Alphabet Inc. AlphaFold has garnered considerable interest within the scientific community for its groundbreaking capabilities in predicting protein structures with remarkable accuracy. Investors looking to capitalize on this cutting-edge technology may consider investing in AlphaFold stock. Here are some key considerations for investing in AlphaFold stock:

Understanding the Technology Behind AlphaFold:

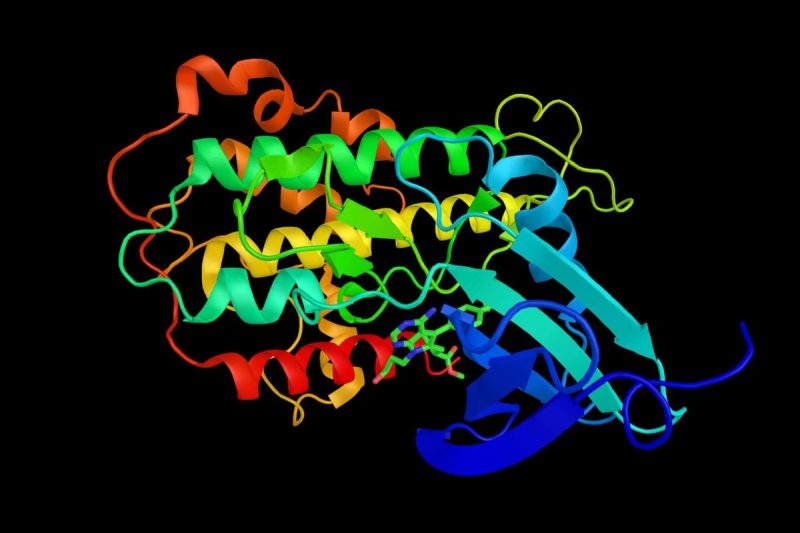

AlphaFold leverages deep learning algorithms to predict protein structures, a process that has traditionally been time-consuming and challenging for researchers. By accurately predicting protein structures, AlphaFold has the potential to revolutionize drug discovery, personalized medicine, and various other areas within the life sciences industry. As investors evaluate the potential of AlphaFold, it is essential to understand the underlying technology and its implications for the broader scientific community.

Assessing the Market Potential:

The market potential for AlphaFold is substantial, given the critical role that protein folding plays in drug development and disease understanding. With the pharmaceutical industry constantly seeking innovative solutions to accelerate the drug discovery process, AlphaFold’s technology holds immense promise for transforming how new therapies are developed. Investors should consider the size and growth potential of the markets that AlphaFold is poised to disrupt, such as pharmaceuticals, biotechnology, and healthcare.

Analyzing the Competitive Landscape:

While AlphaFold has demonstrated impressive results in predicting protein structures, it is crucial for investors to assess the competitive landscape within the AI and life sciences sectors. Competing technologies and companies may pose challenges to AlphaFold’s market penetration and adoption. By conducting a thorough analysis of the competitive landscape, investors can gain insights into how AlphaFold stands out and differentiates itself from its peers.

Evaluating the Investment Risks:

As with any investment opportunity, there are inherent risks associated with investing in AlphaFold stock. Factors such as regulatory hurdles, technological limitations, and unforeseen market dynamics could impact the success and profitability of AlphaFold. Investors should carefully assess these risks and develop strategies to mitigate potential downsides while capitalizing on the technology’s growth potential.

Diversification and Long-Term Perspective:

Investing in AlphaFold stock should be viewed as part of a diversified investment strategy, rather than a standalone opportunity. By diversifying across different asset classes and industries, investors can manage risk and optimize returns in their overall investment portfolio. Additionally, taking a long-term perspective when investing in AlphaFold stock can help capture the full potential of the technology as it continues to evolve and disrupt the life sciences industry.

In conclusion, investing in AlphaFold stock offers a unique opportunity to participate in the advancement of cutting-edge AI technology with transformative applications in the life sciences sector. By understanding the technology, assessing the market potential, analyzing the competitive landscape, evaluating risks, and maintaining a diversified and long-term investment approach, investors can position themselves strategically to navigate the opportunities and challenges associated with investing in AlphaFold stock.