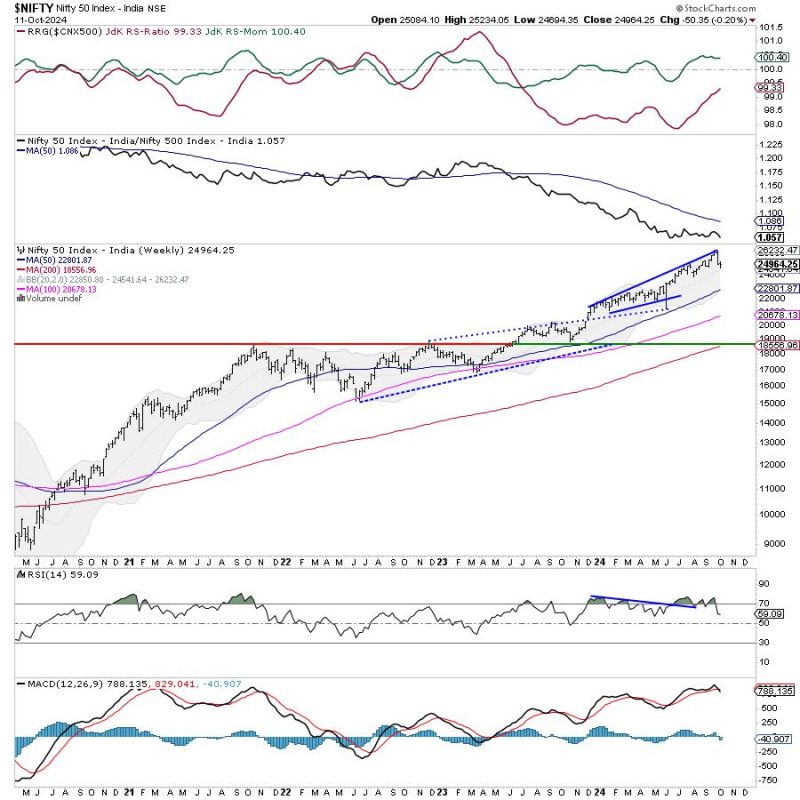

The overall market sentiment seems optimistic going into the week ahead as major indices continue their upward trajectory. Investors are closely watching the Nifty for signs of consolidation, keeping a keen eye on key support and resistance levels to gauge the market’s direction.

The Nifty, the leading benchmark index in India, has seen significant gains in recent sessions, driven by positive global cues and strong domestic fundamentals. However, the index now appears to be entering a phase of consolidation as traders seek to reassess valuations and market conditions.

Key levels to watch in the coming days include the support level at 15,350 and the resistance level at 15,550. These levels will be crucial in determining the short-term direction of the Nifty, with a breakout above the resistance likely signalling further upside potential, while a breach of the support level could trigger a corrective move lower.

Market participants are advised to keep a close watch on macroeconomic indicators and global developments that could influence market sentiment. Factors such as geopolitical tensions, inflation data, and central bank policies could all play a role in shaping market dynamics in the week ahead.

In addition to monitoring key levels on the Nifty, traders should also pay attention to individual stock movements and sectoral trends. Certain sectors, such as technology, healthcare, and consumer goods, have shown resilience in recent sessions and could continue to outperform in the coming days.

Risk management remains a key consideration for investors, especially in times of heightened volatility and uncertainty. Traders are advised to maintain a disciplined approach to trading, setting stop-loss levels and diversifying their portfolios to mitigate potential risks.

Overall, the week ahead promises to be an interesting and eventful period for the markets, with the Nifty consolidating at key levels while investors navigate a complex landscape of opportunities and challenges. By staying informed and vigilant, traders can position themselves to make well-informed decisions and navigate the market with confidence.