Sector Rotation: A Strategic Approach to Investing

Understanding sector rotation is crucial for investors seeking to optimize their portfolios and achieve long-term success. This investment strategy involves shifting investments between different sectors of the economy based on the economic cycle, market trends, and various other factors. Successfully implementing sector rotation requires a deep understanding of the market dynamics and the ability to identify sectors that are likely to outperform or underperform in the current environment.

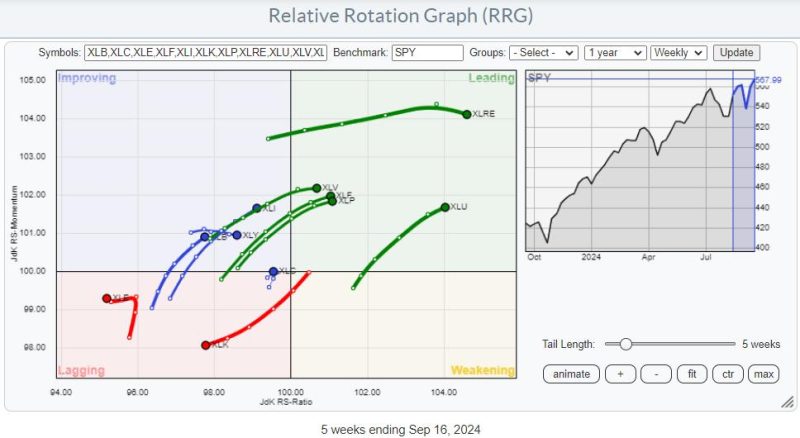

The basic premise of sector rotation is that different sectors perform well at different stages of the economic cycle. For example, defensive sectors like healthcare and utilities tend to perform better during economic downturns, while cyclical sectors like technology and consumer discretionary stocks outperform during periods of economic expansion. By correctly predicting the stage of the economic cycle and rotating investments accordingly, investors can potentially maximize returns while minimizing risk.

One of the key challenges of sector rotation is the difficulty of accurately predicting economic cycles and sector performance. Economic data can be volatile and subject to revision, making it challenging to pinpoint the exact stage of the cycle. Moreover, sectors can be influenced by a wide range of factors, including interest rates, geopolitical events, technological advancements, and consumer behavior. This complexity makes it essential for investors to conduct thorough research and analysis before making any sector rotation decisions.

To address this dilemma, investors can use a combination of fundamental and technical analysis to identify potential sector rotation opportunities. Fundamental analysis involves evaluating the financial health and growth prospects of individual sectors, while technical analysis focuses on price trends and market sentiment. By combining these two approaches, investors can develop a well-rounded view of the market and make more informed sector rotation decisions.

It is also essential for investors to diversify their sector rotation strategy to spread risk and maximize potential returns. Allocating investments across a broad range of sectors can help mitigate the impact of underperformance in any single sector and increase overall portfolio stability. Additionally, investors should regularly review and adjust their sector allocations to adapt to changing market conditions and new investment opportunities.

In conclusion, sector rotation is a valuable investment strategy that can help investors optimize their portfolios and achieve long-term success. By understanding the dynamics of different sectors, conducting thorough research, and diversifying their investments, investors can navigate the complexities of the market and capture opportunities for growth. While sector rotation presents challenges and uncertainties, it also offers the potential for enhanced returns and risk management. With careful planning and strategic implementation, investors can leverage sector rotation to build a resilient and profitable investment portfolio.