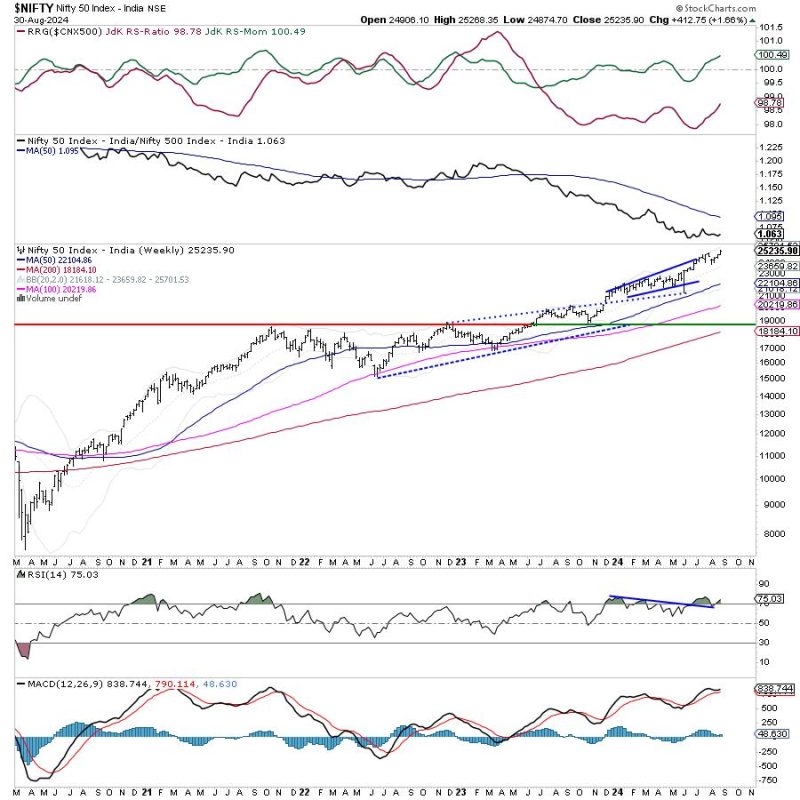

In analyzing the current market trends for the Nifty, various indicators and tools play a crucial role in determining the direction of the market. One such tool is the Relative Rotation Graph (RRG), which provides valuable insights into the relative strength and momentum of different market sectors. The recent analysis of the RRG for the Nifty reveals a distinctly defensive setup that investors need to be aware of.

The RRG tool categorizes various sectors into four different quadrants based on their relative strength and momentum compared to a benchmark index, in this case, the Nifty. The leading sector, which represents strong momentum and relative strength, is usually located in the top-right quadrant. On the other hand, the weakening sector, indicating weaker momentum and relative strength, is positioned in the bottom-right quadrant.

By examining the current RRG setup for the Nifty, it is evident that certain sectors are displaying defensive characteristics. These defensive sectors tend to perform relatively well during periods of market uncertainty or downturns. The defensive setup on the RRG suggests that investors may be shifting towards safer investments, anticipating potential market corrections or volatility in the near future.

While the uptrend for the Nifty remains intact, the defensive stance reflected in the RRG setup highlights the importance of monitoring sector rotations and adjusting investment strategies accordingly. Investors should consider diversifying their portfolios to include defensive sectors that have the potential to weather market fluctuations and provide stability during uncertain times.

In conclusion, the RRG analysis offers valuable insights into the current market dynamics and sector rotations for the Nifty. By being mindful of the defensive setup indicated on the RRG, investors can make informed decisions to navigate potential market challenges and optimize their investment portfolios for long-term success.