Since the inception of cryptocurrency, the financial world has witnessed both incredible innovation and nefarious schemes. The case of a cryptocurrency pig butchering scam that wreaked havoc on a Kansas bank stands as a stark reminder of the risks associated with the digital currency market. This elaborate scheme not only caused financial losses but also led to the downfall of the bank’s ex-CEO, who now faces a staggering 24-year prison sentence.

The intricate scam involved using the allure of cryptocurrency investments in pig butchering facilities to lure unsuspecting investors. The promise of high returns and the ambiguity surrounding the nature of the investment acted as bait for individuals seeking quick profits in the burgeoning cryptocurrency market. However, as the scheme unraveled, it exposed the fraudulent nature of the operation and the extent of the deception perpetrated by the bank’s executives.

The consequences of the scam were manifold, impacting not only the gullible investors who fell victim to the scheme but also shaking the foundations of the Kansas bank. The financial losses incurred by investors reverberated throughout the community, underscoring the need for stringent regulations and oversight in the cryptocurrency space. The revelation of such fraudulent activities further eroded the trust in digital currencies and highlighted the vulnerabilities inherent in decentralized financial systems.

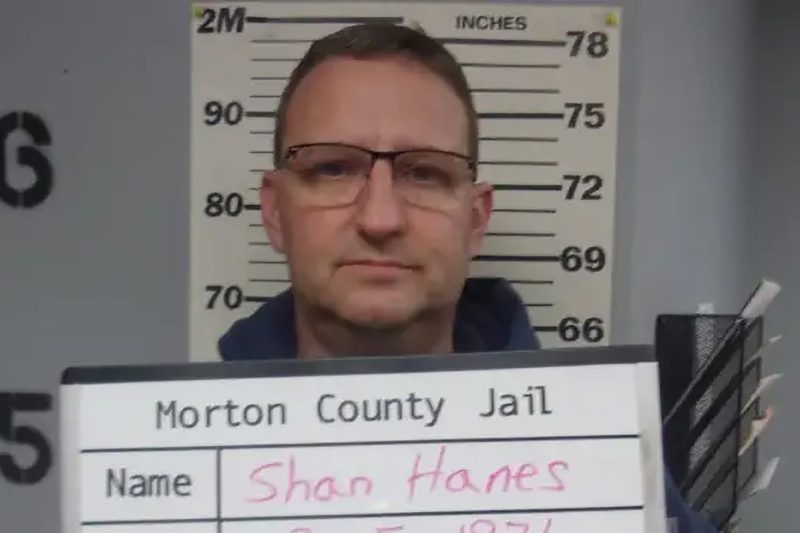

As the authorities delved deeper into the case, the role of the ex-CEO of the bank came under scrutiny, ultimately leading to his conviction and a lengthy prison sentence. The severity of the punishment meted out to the ex-CEO underscores the gravity of the crimes committed and serves as a cautionary tale for others who may be tempted to engage in similar illegal activities. The case serves as a stark reminder of the importance of accountability and transparency in the financial sector, especially in the rapidly evolving landscape of cryptocurrency.

In conclusion, the cryptocurrency pig butchering scam that rocked the Kansas bank serves as a sobering lesson on the dangers of unscrupulous schemes in the digital currency market. The repercussions of such fraudulent activities are far-reaching, affecting not only the victims but also the institutions involved. As the cryptocurrency space continues to evolve, it is imperative for regulators, investors, and financial institutions to remain vigilant and uphold the highest standards of integrity to safeguard against such scams in the future.