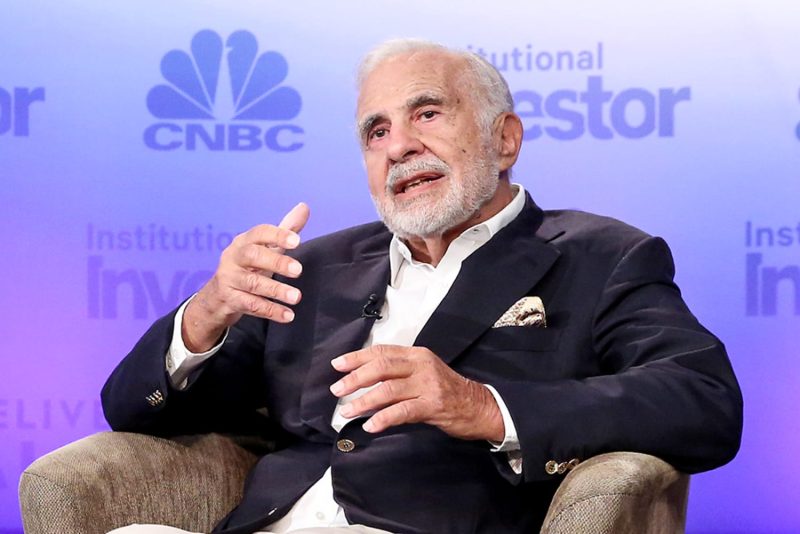

The Securities and Exchange Commission (SEC) has filed charges against billionaire investor Carl Icahn, alleging that he failed to disclose important information about his stock holdings. The SEC claims that Icahn hid billions of dollars’ worth of stock pledges, which he used as collateral for margin loans.

Icahn, a well-known figure in the world of finance and investing, allegedly engaged in a scheme that involved using his sizable stock portfolio as collateral for personal loans without properly disclosing these arrangements to investors and the public. The SEC asserts that Icahn made false and misleading statements regarding the size and scope of his stock holdings, creating a misleading picture of his financial position.

The SEC’s investigation reportedly uncovered evidence that Icahn had pledged nearly $5.3 billion worth of stock in public companies as collateral for margin loans, a fact that was allegedly concealed from investors. This lack of transparency, according to the SEC, allowed Icahn to benefit from advantageous lending terms while potentially exposing investors to unknown risks.

In response to the charges, Icahn has denied any wrongdoing and stated that he intends to vigorously defend himself against the SEC’s allegations. His legal team has argued that the transactions in question were standard market practices and that Icahn’s actions were in compliance with regulatory requirements.

The case against Icahn raises important questions about transparency and disclosure in the financial industry. Investors rely on accurate and timely information to make informed decisions about where to put their money, and any attempts to manipulate or conceal vital details can undermine the integrity of the market.

The outcome of this case will likely have broader implications for the financial sector as a whole, as regulators seek to enforce rules that promote transparency and accountability among investors and corporate entities. As the legal proceedings unfold, the financial community will be watching closely to see how the case against Carl Icahn unfolds and what implications it may have for future regulatory actions.