In the world of finance and trading, technical analysis plays a crucial role in identifying potential patterns and trends in stock prices. One such pattern that traders watch out for is the double top pattern. Today, we will take a deep dive into the double top pattern on semiconductors ETF (SMH) and explore its significance for investors and traders.

### Understanding the Double Top Pattern

The double top pattern is a bearish reversal pattern that indicates a possible change in the trend of a stock or security. It is formed when the price of an asset reaches a peak, retraces, and then attempts to reach a similar peak again before being rejected. Visually, the pattern resembles the letter M, with two peaks at approximately the same level separated by a trough.

### Double Top Pattern on Semiconductors ETF (SMH)

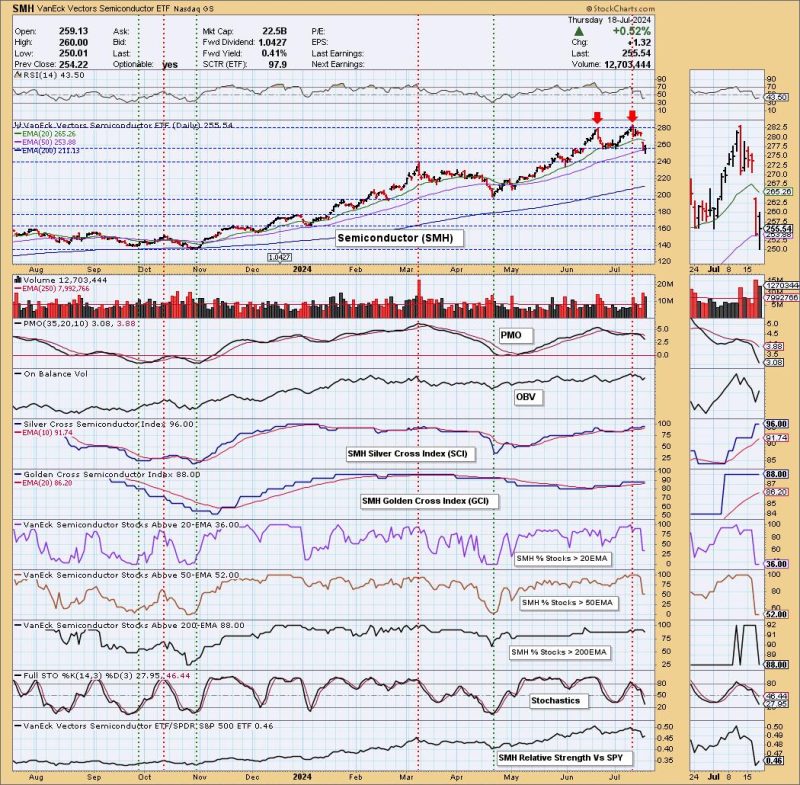

Looking at the chart of the semiconductors ETF (SMH), we can observe a clear double top pattern forming. The ETF reached a peak, retraced slightly, made an attempt to reach the previous high, and was then met with resistance, resulting in a rejection. This pattern suggests that the bullish momentum that drove the price to its previous highs may be weakening, and a trend reversal to the downside could be imminent.

### Implications for Traders and Investors

For traders, the double top pattern on SMH presents a potential opportunity to enter short positions in anticipation of a price decline. Traders may look to establish stop-loss orders above the second peak of the pattern to manage risk in case the price breaks out to the upside.

For investors holding positions in SMH or looking to initiate new positions, the double top pattern serves as a cautionary signal. Investors may consider reviewing their investment thesis, assessing the fundamental factors affecting the semiconductor industry, and monitoring price action for further confirmation of a potential trend reversal.

### Technical Analysis Tools for Confirmation

While the double top pattern alone can be a powerful signal, traders and investors often use additional technical analysis tools to confirm their trading decisions. Tools such as moving averages, volume analysis, and oscillators like the Relative Strength Index (RSI) can provide supplementary information to support the validity of the pattern and help in making well-informed trading decisions.

### Conclusion

In conclusion, the double top pattern on semiconductors ETF (SMH) highlights a potential shift in the trend of the security from bullish to bearish. Traders and investors can use this pattern as a valuable signal to adjust their trading strategies, manage risk, and evaluate their investment positions in the semiconductor industry. By combining technical analysis with fundamental research, market participants can improve their decision-making process and navigate the ever-changing landscape of the financial markets.